The insurance landscape is undergoing a profound transformation, with Artificial Intelligence (AI) emerging as a powerful catalyst for efficiency and customer satisfaction. A recent study has revealed that AI agents are now significantly speeding up the policy issuance process, benefiting nearly half of all insurance customers. This marks a critical shift from traditional, often lengthy, procedures to a streamlined, proactive customer experience.

According to the study, a remarkable 48% of customers now receive their insurance policies within a mere 15 minutes, a drastic improvement from the previous average of four hours.

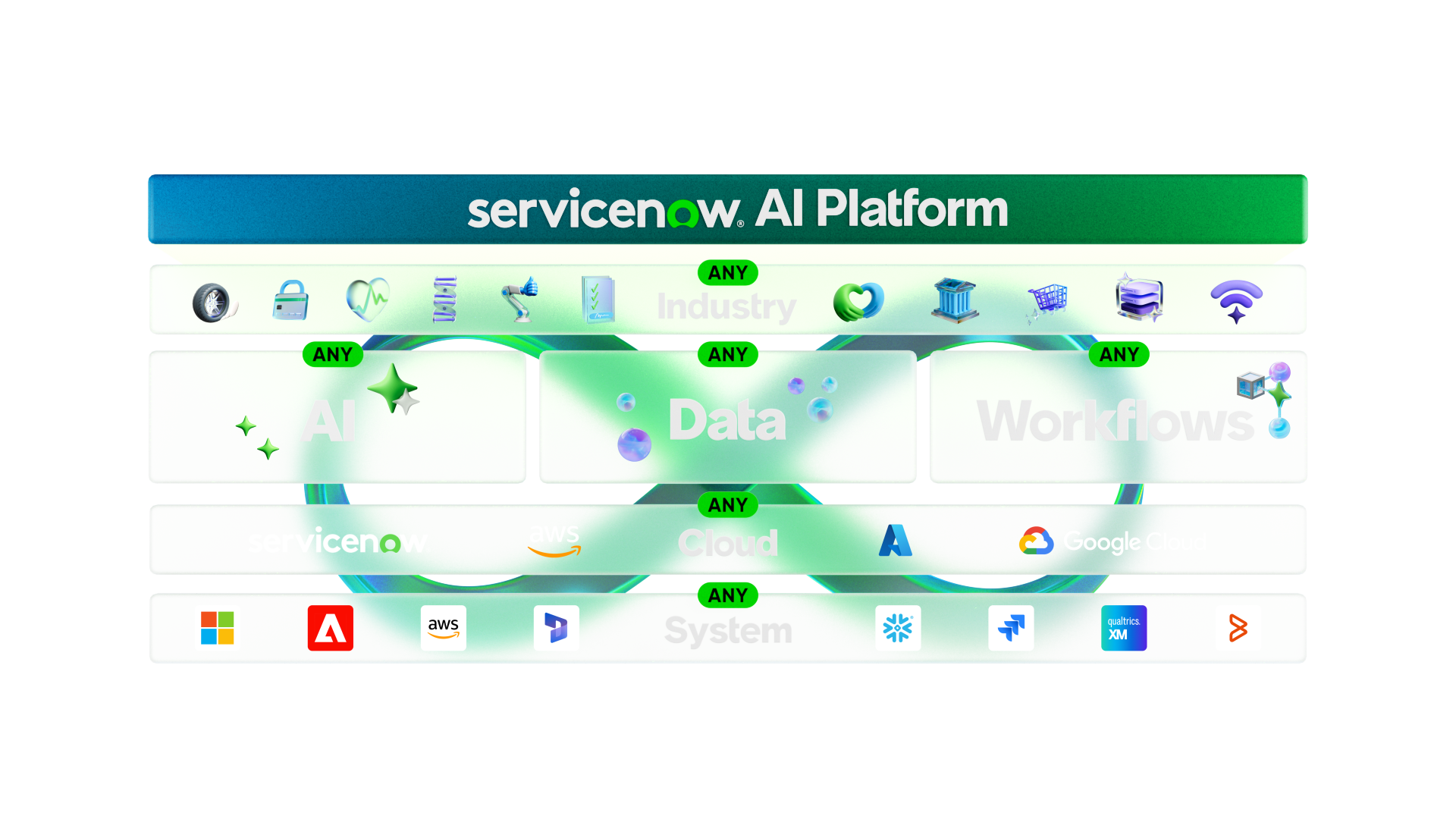

This acceleration is primarily attributed to the sophisticated integration of AI into insurance workflows, with AI now handling 45% of these processes. The rapid turnaround time addresses a long-standing point of frustration for both insurers and policyholders: processing delays that often led to customer drop-offs or deterred purchases.

Beyond just speed, AI is also enhancing the overall customer journey. The report indicates that AI chatbots are now adept at handling 30% of first-contact customer queries, top to a 15% reduction in resolution turnaround time.

This signifies a move towards smarter and more effective query management. AI-driven ticket-tagging engines are proving highly accurate, routing incoming customer tickets to the correct agent with over 84% precision by factoring in query type, history, and urgency.

Saurabh Tiwari, Chief Technology Officer at Policybazaar, highlighted the proactive nature of this AI-driven evolution. “Today, we can anticipate what a customer might need, explain complex products in simple terms, and issue policies in minutes, all without sacrificing accuracy or trust,” he stated.

This shift also enables unprecedented personalization, with over 3 million messages and 5 lakh hyper-personalized nudges being sent daily, tailored to factors like location, age, policy stage, and digital behavior. This targeted approach has not only improved engagement but also boosted intent-to-buy by 20% through AI-driven prompts aligned with life milestones.

The benefits extend to fraud detection as well. AI is now flagging a significant percentage of potential fraudulent claims – nearly 11% in term insurance and around 16% in insurance savings plans. By identifying these cases early, insurers can expedite legitimate claims and bolster customer trust.

While the AI revolution in insurance is clearly accelerating policy issuance and improving customer experience, the industry continues to navigate challenges such as data quality, regulatory compliance, and ethical considerations in automated decision-making.

However, the current trajectory suggests a future where AI agents become an indispensable part of the insurance ecosystem, delivering faster, more personalized, and more secure services to customers nationwide.

![Online Scam Cases Continue to Rise Despite Crackdowns on Foreign Fraud Networks [Myanmar] Online Scam Cases Continue to Rise Despite Crackdowns on Foreign Fraud Networks [Myanmar]](https://sumtrix.com/wp-content/uploads/2025/06/30-12-120x86.jpg)