The United Nations Conference on Trade and Development (UNCTAD) today released its much-anticipated World Investment Report 2025, revealing a nuanced landscape for global Foreign Direct Investment (FDI).

While overall global FDI saw an 11% decline in 2024, marking the second consecutive year of slowdown, investments in the digital economy, particularly in Artificial Intelligence (AI), data centers, and semiconductor sectors, have defied the trend, experiencing a significant surge.

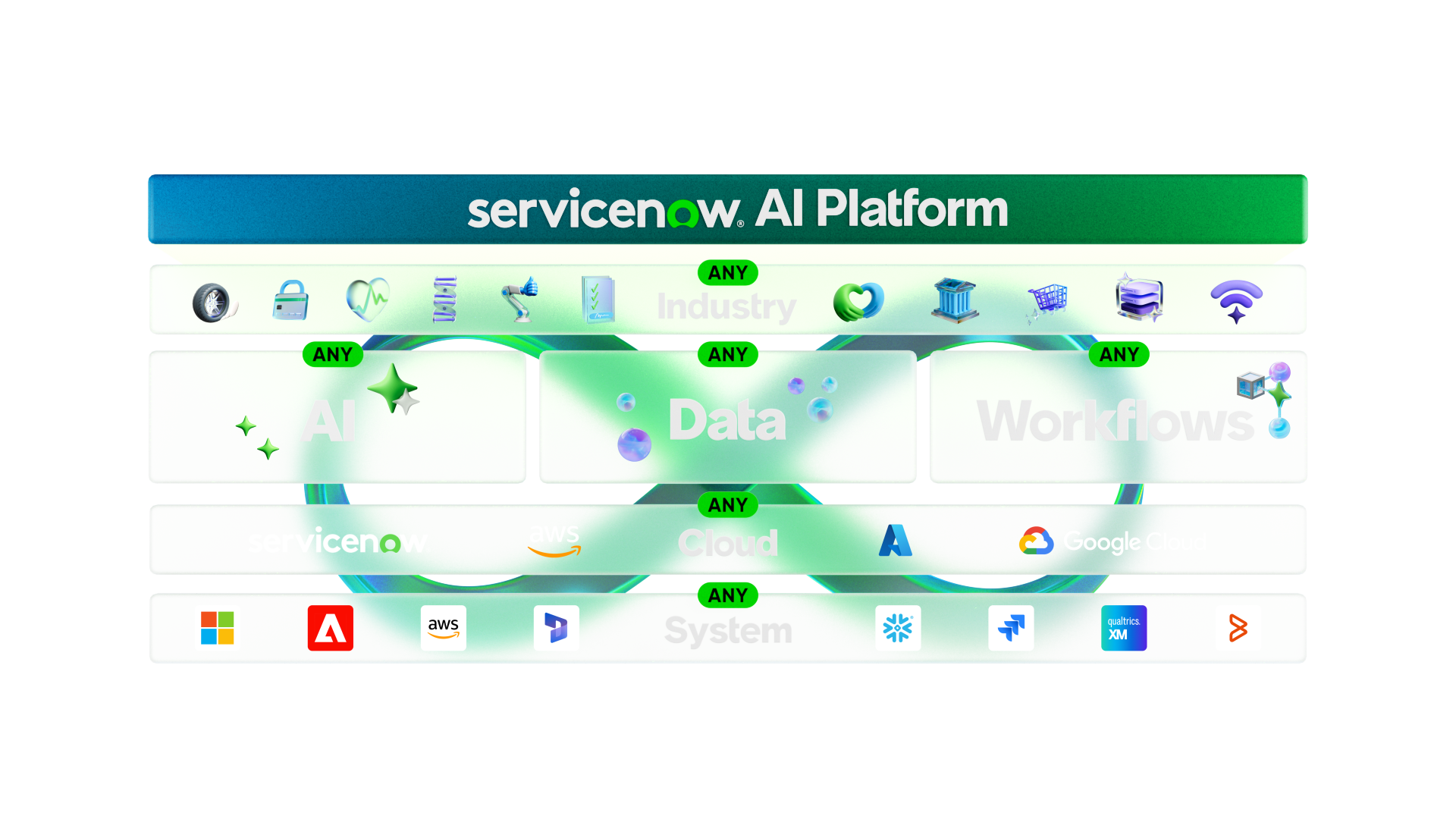

The report highlights that the digital sector has emerged as the primary engine of FDI growth, with project values in this domain doubling. This reflects a global pivot towards a digitally-driven economy, as investors prioritize high-growth technology sectors even amidst prevailing geopolitical tensions and economic uncertainties. The surge in FDI for AI, cloud computing, and digital platforms underscores the critical need for advanced digital infrastructure.

Data centers, the backbone of the digital revolution, have attracted substantial foreign capital. The increasing demand for AI compute power is driving the need for more efficient processes and faster builds of these facilities.

Hyperscale data centers are becoming increasingly popular, and the industry is actively exploring innovative cooling methods and sustainable energy solutions to meet the burgeoning energy demands of AI.

Countries like India are seeing increased FDI in their data center markets, fueled by digital transformation initiatives and rising internet penetration.

The semiconductor industry is another standout performer, witnessing a remarkable increase in FDI. Projections indicate that the global semiconductor market is poised for robust growth, with strong contributions from generative AI (GenAI) chips.

Companies are allocating significant capital expenditures to expand manufacturing capacity, driven by the insatiable demand for more powerful and efficient chips that underpin AI advancements.

Geopolitical considerations are also playing a role, with a push towards reshoring and diversification of supply chains top to increased domestic and regional investments in semiconductor manufacturing.

Despite these positive trends in the digital sphere, the World Investment Report 2025 cautions that investment in sectors crucial for Sustainable Development Goals (SDGs), such as renewable energy and infrastructure, has seen a sharp decline in developing countries. This uneven distribution of FDI poses significant challenges for inclusive and sustainable global development.

The report concludes by emphasizing the need for policymakers to foster an environment that attracts investment not just in high-tech sectors, but also in areas vital for broader societal progress.

Strengthening digital infrastructure, leveraging development banks for SDG financing, and modernizing international investment governance are among the key recommendations to steer capital towards a more inclusive and sustainable future.

![Online Scam Cases Continue to Rise Despite Crackdowns on Foreign Fraud Networks [Myanmar] Online Scam Cases Continue to Rise Despite Crackdowns on Foreign Fraud Networks [Myanmar]](https://sumtrix.com/wp-content/uploads/2025/06/30-12-120x86.jpg)